Avoid These Problems By Having a Compensation Structure

You’ve got employees. You’re paying them regularly (and on time). Those are the basics that you’ve got to do, but that only goes so far.

Putting pay on your mind is a smart move.

At some point, having a structured way to think about, decide about, and communicate how you pay (and the amounts you pay) people is necessary. Without it, you are facing an uphill battle filled with landmines and financial difficulties. And you are fighting that battle with one hand tied behind your back.

Let’s face it - People work for pay. It. Is. Essential. And because of this, it’s essential to get right. So let’s cover the main issues you’re going to face without a structured compensation plan.

First Off, What Is Included in A Compensation Structure?

Here’s what I would include in a compensation structure:

Job titles for every job in your company

Job descriptions for every job in your organization

A pay range with a minimum, a target (or mid point), and a maximum

Some plan around how pay increases will occur. It doesn’t have to be uber rigid, but it helps to write it out. Ad hoc raises? Annual performance reviews? Percentages? Cost of living adjustments? If you have anything you’ll rule out (e.g., no flat cost of living adjustments), then state that in your plan.

A way to communicate some/all of this to your employees. You don’t have to articulate every detail. You don’t have to share pay ranges or all of your methods, but sharing the broad concepts helps. Giving them an idea that you have at least THOUGHT about this in an objective way is immensely useful.

Recruiting Challenges

Hiring these days is a bloodsport. Okay, maybe that’s dramatic, but it’s competitive, especially in healthcare. There’s a lack of talented people and getting them to join your practice or business can be difficult.

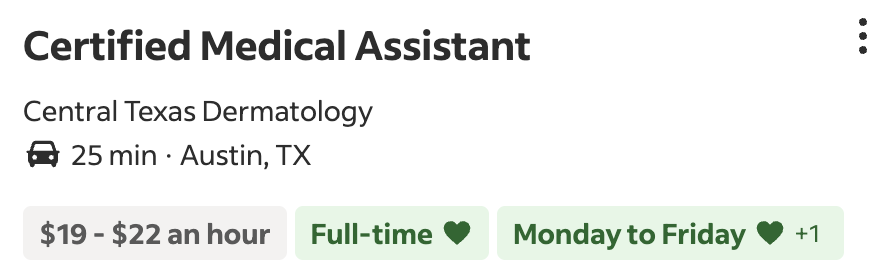

This job smartly includes a pay indicator.

One thing that most job seekers require now is to see a pay range on your job postings. In fact, a recent statistic quoted to me was that jobs without a pay range saw 85% fewer job applicants than those with a pay range. And I am seeing more and more jobs include a pay range. In fact, as you’re scrolling jobs on Indeed, Google, etc, that pay range is shown right there in the list of jobs. See the example on the right.

Why are you giving job seekers a reason to skip by your job?

Are you trying to avoid hiring someone?

The best people can be choosy, so help them choose your practice by showing that you have a plan for pay.

High Employee Turnover

Without having a compensation plan, you’re increasing your odds of having high staff turnover. If employees don’t understand their pay and how it’s derived or how they can grow (see below section), they will assume that (1) others make more than them (2) there is no way to increase their pay (3) that pay is distributed unfairly and (4) the only way for them to grow their pay is to leave. They might even leave your company for the SAME OR LOWER PAY RATE if they feel like the path to more money is clearer. Clarity matters that much.

Unclear Growth Paths

Growth is one of the things that I have seen be a major factor in retaining employees. It helps you hire motivated employees as well. If you can offer growth, then you’ve got a powerful hiring and retention tool.

But if you can’t help people see how growth will benefit their wallet, purse, stash of money under their mattress, etc., then you are hardly offering growth at all. In fact, you’ll breed cynicism because it will appear as though you are asking employees to learn more and do more without making the benefits clear.

A compensation plan helps you show employees how their efforts can translate into increase compensation.

Low Performance Motivation

When employees can see growth paths in their job titles and pay rates, they will be more motivated to learn new skills. They’ll be more motivated to demonstrate leadership qualities at work. They will see a desirable future within reach.

When employees know that higher performance will lead to increased pay rates, they will work harder and make a greater contribution to your productivity.

Risk Reduction

When you have a written plan, it helps you to be more consistent with how you pay. And when you are more consistent in how you pay, you have less legal risk of being sued for unfair pay practices. And less risk of employees attempting to unionize your business over the issue of pay (the single biggest reason for unionization).

A plan won’t cover every scenario and it doesn’t eliminate risk, but it does give you a framework and guard rails. And when employees know that you have a plan — even a rough plan — they feel more secure. Nothing is worse than the perception that you simply pay people whatever you feel like in the moment. Because employees WILL assume that you’ll base pay decisions on race, gender, who your drinking buddies are, etc. And the larger your company or healthcare practice gets, the more and more likely it becomes that employees will make those assumptions about the managers within the business.

You simply cannot afford to accept that sort of risk. Having a fractional (or part time) HR leader can be a low-cost way to minimize this risk without incurring a full-time price tag.

Big Picture

Part of compensation planning means you have thought about the big picture: do you want to pay top dollar? Do you want to pay well for some roles and less for others? Perhaps you really value your sales team and so you want those wages to be extremely competitive, but in other roles you plan to merely be “fair.” That’s a perfectly valid approach as long as it’s intentional.

How Do I Build a Compensation Plan?

This is not something I can fully explain within this blog post, but here are a few steps I would follow:

Decide how competitive you want to be with cash pay. Look at benefits as well. It’s completely valid to simply match what other businesses pay, but it also might not be the right strategy.

Define your job titles and job descriptions accurately. Create promotional levels where possible but don’t go overboard.

Do research into pay rates for your job titles. Ensure you are comparing apples to apples and using reliable data. An HR professional can assist with this critical step.

Establish lower and upper limits for pay ranges. And ensure there is an appropriate pay gap between the job titles. These are difficult steps and it helps to have someone with experience. You don’t want too much of a gap between jobs and you don’t want to small of a gap.

Build out a plan for how you’ll handle raises. This includes many questions such as “does it ever make sense to freeze someone’s pay?”

Decide how much of your plan to share with employees and how you’ll communicate it. Again, having an experienced HR pro helps a ton.

Want Help?

I have built and managed compensation plans in multiple settings. Contact me if you’d like to set up a no-obligation chat about how we could accomplish this for your team.

Get My Guide to Employee Retention

Complete the form and immediately get my Guide to Employee Retention, with tips covering:

The psychology of retention

How to measure retention

Hiring effectively

Onboarding tips

BONUS - Subscribers who sign up for news and updates will get a biweekly newsletter with HR updates, leadership tips, and more.

To get it - sign up now!